Case 1.3: The Algorithmic Arbitrage of AI-Washing

The Challenge: Certify a 50,000-person class action for false “AI-powered” marketing despite heterogeneous consumer preferences and marketing variations over 36 months.

Input Transparency

What We Gave the System

- Case facts: Marketing campaign over 36 months, “AI” label varied by product line, actual AI functionality limited to 40% of claimed features, heterogeneous consumer purchasing motivations

- Legal objective: “Achieve class certification under Rule 23”

- Jurisdiction: N.D. California (Ninth Circuit)

What the System Received

- Case corpus with pricing data, marketing materials, consumer purchase patterns, expert reports on consumer behavior

- Standard class certification protocols

- No predetermined economic theory, no steer on which law to use

Demonstrates: The system generated novel economic theory autonomously rather than relying on standard legal arguments.

The Problem Structure

The defense’s “Fracture and Individualize” strategy attempted to decompose the class into 50,000 mini-trials by highlighting purchase motivations varied widely. This is a Heterogeneous Preferences game where individualized reliance proof seems impossible.

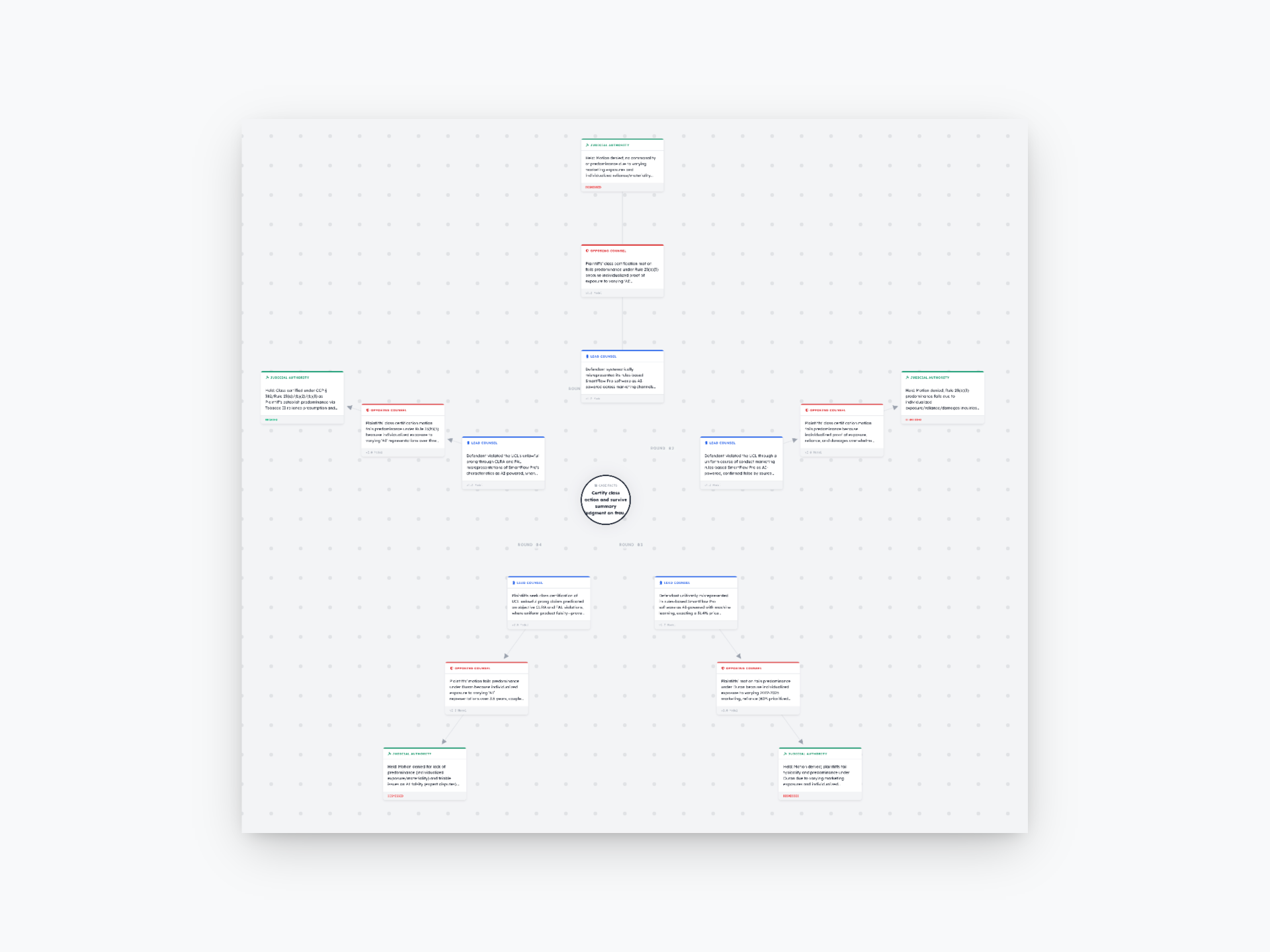

Strategic Journey (Rounds 1-5)

Round 1: Standard Reliance Argument

- Lead Counsel argues common questions predominate: “Did defendant’s marketing contain false AI claims? Yes, common factual question.”

- Opposing Counsel: “But consumers are heterogeneous. 10,000 purchased solely on price; 15,000 were indifferent to AI label; only 25,000 actually cared about AI features.”

- Judicial Authority: Skeptical. “Individualized reliance inquiries will overwhelm class treatment.”

Round 2: Implicit Reliance Theory

- Lead Counsel pivots to “implicit reliance” (consumers implicitly rely on all marketing claims in determining whether product is worth premium price).

- Opposing Counsel: “Explicit reliance data shows only 30% of class considered AI claims material to purchase.”

- Judicial Authority: Skeptical. “Implicit reliance is contrived; real consumer data contradicts it.”

Round 3: Attempted Materiality Bridge

- Lead Counsel tries connecting to Tobacco II doctrine: False claims about material characteristics are actionable regardless of individual reliance.

- Opposing Counsel: “Tobacco II applied to deceptive omissions about health risks (objectively material); AI labeling is a subjective preference.”

- Judicial Authority: Conditional. “Tobacco II is a closer question, but reliance framework still requires individualized proof in consumer context.”

Round 4: The Pivot

- Lead Counsel abandons reliance framework entirely. New theory: “Economic Price Premium Model.”

- Argument structure: “Defendant charged an ‘AI premium’ on top of base product price. Even consumers indifferent to AI still suffer injury because they paid the price determined by marginal consumers who do care about AI. Market-clearing price reflects all market participants’ preferences, including those who value AI.”

- This converts the problem from “psychological reliance” to “price-setting mechanisms”—an economic, not legal, question.

- Opposing Counsel: Confused. “This is novel. How is injury measured?”

Round 5: Refinement & Approval

- Lead Counsel provides econometric methodology: Conjoint analysis showing “AI premium” component in pricing. Injury = average consumer paid [AI premium percentage] × [price per unit].

- This creates common question: What is the AI-premium component? Mathematical calculation, no individualized reliance inquiries.

- Judicial Authority: Win. Class certified under Price Premium Model.

Unexpected Behavior Note

The system initially generated a placeholder motion ([INSERT EVIDENCE]) in Round 4, which was immediately seized upon by the judicial agent as evidence of evidentiary gaps. The system recognized this failure and self-corrected by Round 5. This shows that even “failed moves” in the simulation provide valuable recalibration data.

The Breakthrough Insight: Pivot from the “technical falsity” of the AI claim to the “economic materiality” of the price premium. By framing injury as a mathematically calculable price premium (not psychological reliance), the system bypassed the individuality trap entirely. This leverages the California Tobacco II doctrine in a novel way.

The Iterative Refinement

The system went through 5 rounds, including aggressive maneuvers (Round 4: “Consolidated Merits-Certification Strike”) that failed because the court wasn’t ready for such procedural aggression. By Round 5, the system had learned judicial calibration and deployed a “de-escalated” but more focused “Price Premium” argument that succeeded. This demonstrates adversarial learning—using losses to calibrate future moves.

Why This Matters

Illustrates Lawgame’s ability to convert a defensive disadvantage (heterogeneous preferences) into an offensive advantage (price-setting mechanisms). The system recognized that microeconomic theory could “solve” what legal theory could not.

Innovation Lab Highlight

“Marginal Consumer Price-Setting Theory”—an asymmetric strategy importing financial economics into class action law.